Money Budgeting Tips

Who doesn’t want to have extra cash in the bank and in their pocket? Yet, not many know how to do so without receiving a raise at work or working their tails at multiple jobs.

If you want to have more money, but are stuck, perhaps it’s time to rethink being wealthy. Many people are wealthy, without making more than an average salary.

If your goal is to get to a point where you are financially set, the first thing you have to get good at is handling your finance the smart way. You need to know how to budget your money to hold onto more of it, and not to squander it away in poor money habits.

TIP 1: Write Out Your Bills

The first thing to do is simple, write out the bills you have.

Start with the necessary things that you have to spend money on. Seriously, what do you have to pay every month? This only includes the necessities, not the extras. Think about utilities, rent, car payments, and things along those lines.

Get the exact dollar amount and make sure that you know what each cost is and how you are paying it. Once you have an amount, you’ll be able to move forward. Do not move forward without this.

TIP 2: Know Where the Money Goes

Next, focus on where you’re spending your money.

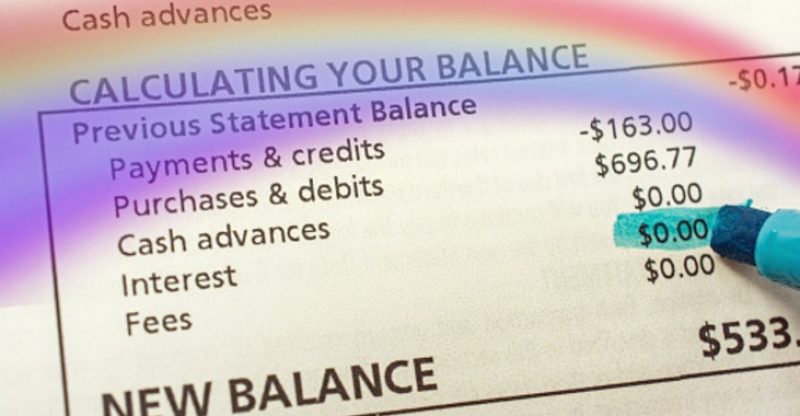

Think about food, entertainment, and things along those lines. You want to focus on figuring out where you’ve spent money in the past 30 days. So go to your bank and pull out transactions history within the last 30 days.

As you look into that, make sure that you highlight areas that are frivolous or unnecessary in regards to spending. Once you highlight those things, you’ll be able to add up how much money you can save by excluding those purchases.

TIP 3: Set a Real Budget

Now that you know where you money is going, write down a list of things that you must pay and what you don’t have to pay. Within that list, focus on putting dollar amounts to everything, and curtail unnecessary spending with moving forward.

Pay your bills, and with the extra money, focus on putting away at least 10% it. The more surplus you can put into savings, the better. You can be frugal, without going into extremes.

Test this out for at least 30 days, and see how much you can save by next month.

Receive More Contents From Us

You Have Been Accepted As A New Challenger.

*Error: Please ensure it's a valid email that hasn't been used.

I know the sleeping tips offer quality sleep, but is there any other which gives these kinds of improvement?